One of the most important things you can do to protect yourself, your employees, and anyone else who might interact with your business is to insure it. This includes outside contractors and members of the public.

If something bad happens, your company is found to be at fault, and you don’t have the right insurance, you could be hit with punitive charges like legal fees and compensation payments. If you don’t have enough insurance, this could happen to you.

Because of this, you should sign up for a policy that covers everything as soon as possible. But since some types of insurance are required by law, and still, others aren’t necessary for your business. So which ones should you include in your policy?

Here, we’ve explained the main types of insurance that every business owner must have or should strongly consider getting.

Types Of Business Insurance

1. Employers’ Liability Insurance

You could be held responsible for any accident, illness, or injury to one of your employees because they work for your company.

Employer’s liability insurance pays for any legal or compensation costs that come up if a current or former worker sues your business.

You must have 5 million pounds of employers’ liability insurance even with one employee. Most plans restrict payouts to £10 million.

This regulation does have certain very specific and restricted exceptions, though. The most important of these is when you get money from the government or only hire people from your own family.

Any business that doesn’t have the right employers’ liability insurance could be fined up to £2,500 a day for each day they don’t have enough coverage.

2. Motor Insurance

If your business uses cars in any way, you will also need commercial auto insurance.

You are required to get at least third-party liability auto insurance. This protects you financially if you hurt someone or damage their property with one of your vehicles.

By law, your car insurance policy has to cover injuries to people up to an unlimited amount and damage to property up to at least one million pounds.

Several financial institutions and private lenders give out business motor insurance loans. However, you must consider taking out loans without a guarantor from a direct lender, as these loans are quick and come with negotiable terms.

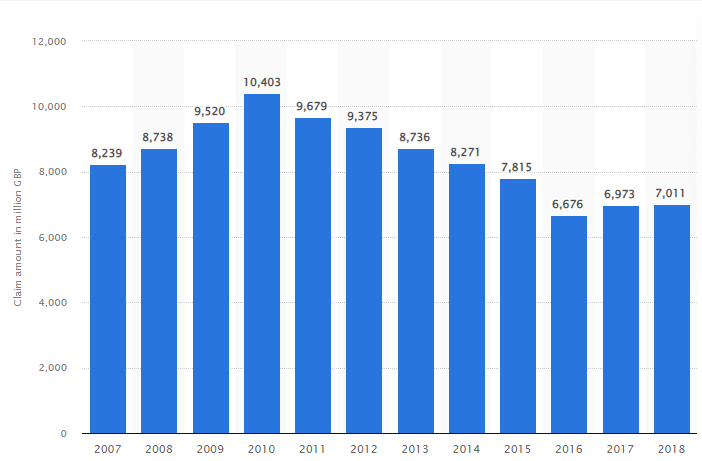

The graph shows the total number of motor insurance claims incurred in the UK from 2007 to 2018:

Source: Statista

3. Insurance against Lawsuits and Claims

Your business could be held responsible if one of your customers or a member of the public gets hurt. Or has their property been damaged on your property or as a direct result of your work?

Since this is the case, we strongly suggest getting public liability insurance, even though it is not required by law. If a public member files a claim against you, this insurance can help pay for some of the compensation and legal fees.

If your business gives professional advice to clients, you might also want to think about getting professional indemnity insurance. This covers the costs of defending yourself and settling claims made against you.

It can save you if you make a mistake, are careless, or give bad advice. For example, if the advice you give to a client or customer hurts their reputation or makes them have trouble paying their bills.

Having professional indemnity insurance is not required by law. However, there are some industries where professional bodies and regulators require you to have at least a certain amount of coverage.

4. Property Insurance

Buildings insurance is good for a company if it owns the property. It helps pay for damage to the building that a flood or a fire may cause.

The protection can cover damage that wasn’t done on purpose and the costs of figuring out what caused, say, a water or gas leak.

When figuring out how much property insurance you need, you should consider how much it will cost to fix or rebuild the property. Plus, how much will it cost to replace any fixtures and fittings and clean up the site?

The cost to rebuild isn’t the same as the property’s current market value. Therefore you need to include the cost of the professional fees needed to assess the property’s value.

Even if you don’t own any property, you should usually get insurance. It helps cover the cost of replacing or fixing any important equipment, furniture, fixtures, or stock stolen or damaged.

If you don’t have insurance, consider taking one for your property. One of the benefits of this is that many banks will let you take out a loan against your insurance policy if you meet certain requirements. You can also reach out to private institutions for private money now in the UK for the same.

5. Financial Insurance

Everything may be going great, but if one of your customers declares bankruptcy or can’t pay their bills, it could ruin your cash flow and put your business at risk. Because of this, trade credit insurance is a must for any business that sells goods or services on credit. If a client pays you late or goes bankrupt, you won’t lose money because of this insurance.

It can also give you the confidence to make and keep business contacts. So try to make your company more appealing to investors and business partners in your field.

6. Cyber Insurance

The digital world has created a lot of new risks, such as online fraud and the theft of customer data. It has also completely changed how businesses work and communicate with each other and the people they serve.

Criminals might trick you into giving them money, lock you out of your own IT systems, or steal important information.

Because of this, every small business in the modern world should think hard about getting cyber insurance. It could help pay for the costs of getting your business back up and running after a cyber attack.

It can fix any damage to your reputation that the attack may have caused. In addition, it can compensate you for lost income caused by a data breach. Plus, protect you financially if someone sues you for not following the rules of the GDPR.

Conclusion

If an accident, injury, or other disaster happens, having the right mix of insurance coverage may give you peace of mind. Insurance makes it less likely that a lawsuit against your company will cost so much money that it will put you out of business.

Even so, you are still responsible for some things. Still, you should make an early assessment of any possible risks. You need to put safeguards in place to protect your company, its employees, its customers, and members of the general public.

For this, the possibility of ever needing to file a claim against your insurance coverage will be significantly reduced. Your insurance company can help by responding quickly and effectively when things go wrong. They can also advise you on finding and handling risks properly. Even though many other types of insurance are more specific and fit specific needs, a complete business insurance plan should focus mostly on the above coverages.